Vesper

Vesper is an established North American developer, owner and operator of utility-scale solar and energy storage assets.

Company Overview

Vesper is an established North American focused utility scale solar and energy storage company that was founded in 2015. Prior to the acquisition of the company by Elda River in 2020, Vesper was owned by Lendlease Development, a publicly traded Australian company.

Elda River Investment

Elda River has had a long-term relationship with the Vesper management team, and in early 2020 engaged with the team to explore a management buyout of the business from Lendlease. Elda River closed on the acquisition of Vesper in November 2020. The investment was directly originated by the Elda River team.

Elda River Approach

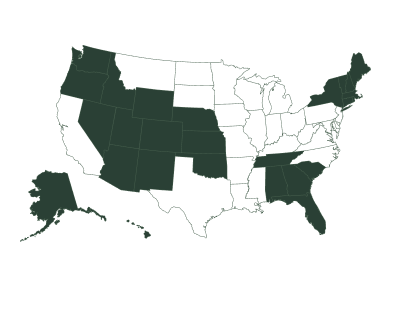

Elda River’s investment in Vesper provided us with exposure to the rapidly growing utility scale solar and energy storage infrastructure buildout across North America. We believe our investment benefits from the geographically diverse development pipeline at Vesper and a significant power purchase agreement (“PPA”) portfolio with investment grade counterparties. We also benefit from a strong, well-aligned management team and control governance of the business.

Company Benefit

Vesper benefits from Elda River’s significant financial and operational experience in solar and energy storage, as well as Elda River’s strong structuring expertise. At closing, Elda River played a key role in negotiating and documenting a large letter of credit (“LC”) facility for the company.

“This investment complements our existing solar portfolio companies and reflects our continued commitment to providing growth capital to businesses actively reducing carbon emissions.”

Since Close

Since closing in the fourth quarter of 2020, Vesper has grown its contracted asset backlog meaningfully, with over 1 GW of contracted capacity as of September 2023. Vesper’s contracted assets have an average power purchase agreement term of greater than 15 years, with very strong counterparties. Vesper recently announced a significant commercial relationship with Pfizer, whereby Vesper is effectively powering 100% of the projected power needs of Pfizer’s North American operations through solar energy at Vesper’s Hornet project.